Client: Q2

Industry: Financial Services

Location: Austin, Texas

Key Industry Trends

- The Financial Services Sector faces ongoing disruption.

- Check and ACH fraud costs billions each year to financial institutions.

- Enterprise Cybersecurity teams are facing unprecedented challenges when it comes to protecting sensitive corporate data from exposure, leak and theft.

- 75% of financial institutions say that their data is aggregated across all processes and systems*, yet there is no effective way to leverage all data across the enterprise to improve decision-making and impact business performance.

- The majority of Financial Institutions are late adopters of SaaS solutions because of cybersecurity threats and privacy risks from sharing sensitive customer data to 3rd party providers of such services.

Industry Landscape

As user expectations and digital experiences of financial services rapidly evolve in fundamental ways, change-averse organizations are falling further behind. Financial institutions (FIs) that develop a digital transformation strategy that leverages data to improve decision-making and impact business performance are making strides in improving efficiencies.

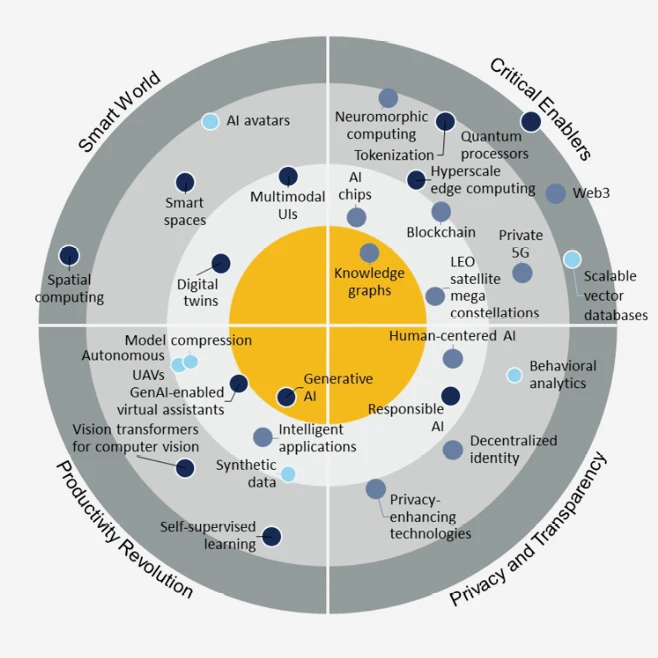

One of the most significant impediments to leveraging company data is the sensitivity of the source data. The intermingling of sensitive data with actionable data presents an opportunity for companies to benefit from the most innovative breakthroughs such as privacy-enhancing technology. Shifting the financial mindset towards utilizing emerging technologies will have an ongoing and lasting impact for how FIs can do business efficiently while providing an inflection point for long-term growth.

Needs

This case study highlights how Q2, a leading provider of digital transformation solutions for banking and lending, applied a breakthrough technology to:

- enable check fraud detection for their entire landscape of customers and

- expand open access to state-of-the-art computer vision-based fraud detection.

By enabling its financial institution customers to take advantage of Q2’s privacy-preserving fraud detection solution, more FIs can improve business efficiency without revealing personally identifiable information (PII) and sensitive data that data governance and security protocols prevented them from doing prior to this.

This case study demonstrates how Protopia AI’s Stained Glass Transform™ (SGT) technology has enabled Q2 to accurately:

- identify check fraud,

- accelerate their time-to-market, and

- give their clients peace of mind

because of a state-of-the-art AI-based privacy-enhancing solution.

Situation

Q2 has established a strong market leadership position with a suite of highly successful security, compliance, and fraud detection applications that they develop and deliver to their clients worldwide. Given the tectonic changes occurring in the industry and global economy, Q2 has sought to:

- Expand open access to industry-leading fraud detection solutions and

- Establish a sustainable competitive advantage.

As the first step in this direction, Q2 realized that a vast majority of FIs would find it very compelling if they could utilize a check fraud detection service that would not require them to share their clients’ plain source data

(e.g., check images) in the process. For example, the Q2 Sentinel team (https://www.q2.com/product/sentinel) is working to expand the adoption of their existing cloud-based SaaS applications to those clients that are underserved or unserved today. To do so, Q2’s underlying challenges are to:

- Satisfy their clients’ data privacy requirements in an agile, adaptive and non-intrusive way and

- Reinforce its industry leadership by providing state-of-the-art solutions that provide a sustainable competitive advantage.

How does Q2 work with their clients today? Q2’s current FI customers accept that given the state-of-the-art nature of security and privacy processes Q2 exercises, there is little to no risk of sending sensitive data to their SaaS products. As Q2 explores offering new solutions, they find that utilizing the latest privacy-enhancing technologies as a centerpiece of their digital banking solutions enables them to not only meet their voice-of-customer-based needs but also greatly increases the accessibility of their solutions. The process of convincing a high-level decision-making team that their data is as safe as can possibly be is much easier to navigate when the data controller can tangibly see that the information they expose to the external world is minimal.

Ultimately, Q2 seeks to provide its state-of-the-art digital banking solutions and exploit the power of ML/AI with maximal data protection as a core tenant of enabling efficiency to as many FIs as possible. Q2 has chosen to work with Protopia AI to use its unique privacy-enhancing technology to expand open access to industry-leading fraud detection solutions.

__________________________________________________________________________________

Solution

The Q2 team was seeking to enable an existing ML-based check fraud detection service to:

- Detect fraudulent checks without the need to analyze plain check images and

- Work at the same level of accuracy as if it were using the plain check images.

If Q2 could find a way to minimize resistance to SaaS ML applications that include sensitive data for inference, Q2 would be able to expand open access to industry-leading fraud detection solutions and deliver peace of mind to potential clients who are reluctant to share any source data that is intermingled with sensitive information.

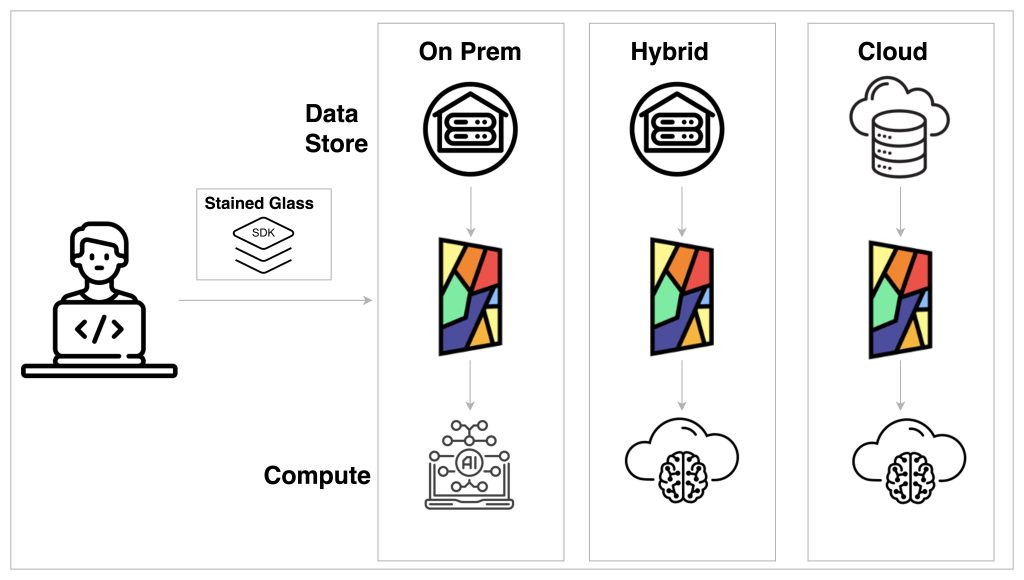

Shortly after the teams jointly defined the statement of work, Protopia AI developed an adaptive methodology that would enable Q2 to use their existing application without the need to make any significant changes to their software. Although most AI-based data privacy services take months to implement, Q2 used Protopia’s Stained Glass Transform™ (SGT) to augment their ML process in just a few days. SGT provided a simple, safe, and secure way to enable privacy protection for an ML model that Q2 had already created.

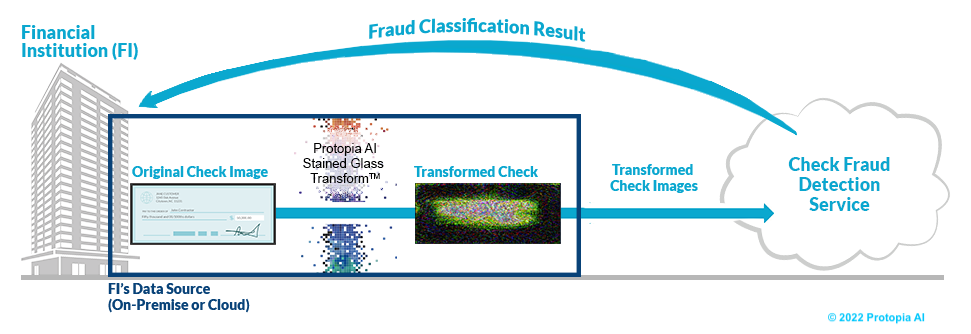

Protopia AI Stained Glass Transform™ is the industry’s first solution that enables service providers like Q2 to create or enhance financial service applications that don’t need access to plain source data to make their predictions. The diagram below shows how this solution only receives the information that’s needed to identify fraudulent activity in the case of Q2’s check fraud detection. This sophisticated technology programmatically transforms sensitive data from the left to randomized data on the right and adds a new layer of protection against data leakage.

Q2 Case Study: ML Service Detecting Fraudulent Checks Without Needing Plain Check Images

Value Proposition: Reduce Resistance to Cloud-Deployed ML Applications Due to Data Sensitivity

An overarching benefit of the simple, safe, and secure Stained Stained Glass Transform is that this patented technology can be used for any datatype:

- Tabular data such as client information,

- Text data such as legal documents,

- Visual data such as check images

- And more.

This minimalist approach to maximal privacy protection enables AI/ML-based applications to only receive the information that’s required for inference on a need-to-know basis, nothing else. By enabling leading financial service providers like Q2 to operate their machine learning models accurately without needing to ingest identifiable inference data from their customers, Protopia AI helps providers expand open access to industry-leading fraud detection solutions to a new segment of the FI market that normally would prefer only on-prem solutions in order to avoid sending their data to a 3rd party cloud.

__________________________________________________________________________________

Conclusion

By leveraging a breakthrough innovation from Protopia AI, Q2 has created a Minimum Viable Product (MVP) that its Sentinel team can use to create a sustainable competitive advantage by rapidly delivering innovative solutions. By expanding open access to industry-leading fraud detection solutions, Q2 accelerates time-to-value for potential clients who were previously unapproachable because their internal data governance protocols prevented them from working with SaaS solutions that didn’t have a way of using corporate data which included sensitive data (e.g., PII).

In addition, Protopia’s Stained Glass Transform enabled a quick time-to-market and eliminated the disruption of using an already existing fraud protection application that has already met with widespread success around the world. Q2 and Protopia AI’s collaboration created an enhanced solution in a few days compared to what other more complex and resource-intensive projects would have taken several months – a result that notably exceeds the industry norm.

To download the PDF version of this blog, please click here.

For more information about the Stained Glass Transform, watch the brief video here: Introducing Protopia AI Stained Glass Transform™.

__________________________________________________________________________________

About Q2 Holdings, Inc.

Q2 is a financial experience company dedicated to providing digital banking and lending solutions to banks, credit unions, alternative finance, and fintech companies in the U.S. and internationally. With comprehensive end-to-end solution sets, Q2 enables its partners to provide cohesive, secure, data-driven experiences to every account holder–from consumer to small business and corporate. Headquartered in Austin, Texas, Q2 has offices worldwide and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com.

Q2 PrecisionLender, an advanced analytics and pricing software that is used by over 15,000 commercial bankers globally and was used to price more than $3.7 trillion in loans in 2020, empowers bankers to improve loan yields by optimizing credit spreads, loan origination fees, and unused loan fees. Q2 PrecisionLender helps bankers save time, provide faster client service, and structure better deals by providing on-the-spot “virtual coaching” by suggesting options for such aspects as amortization, loan-to-value, non-credit products or collateral.

Footnotes

* State of Innovation in Banking, Arizent Research (Sept. 2022)