Financial Services

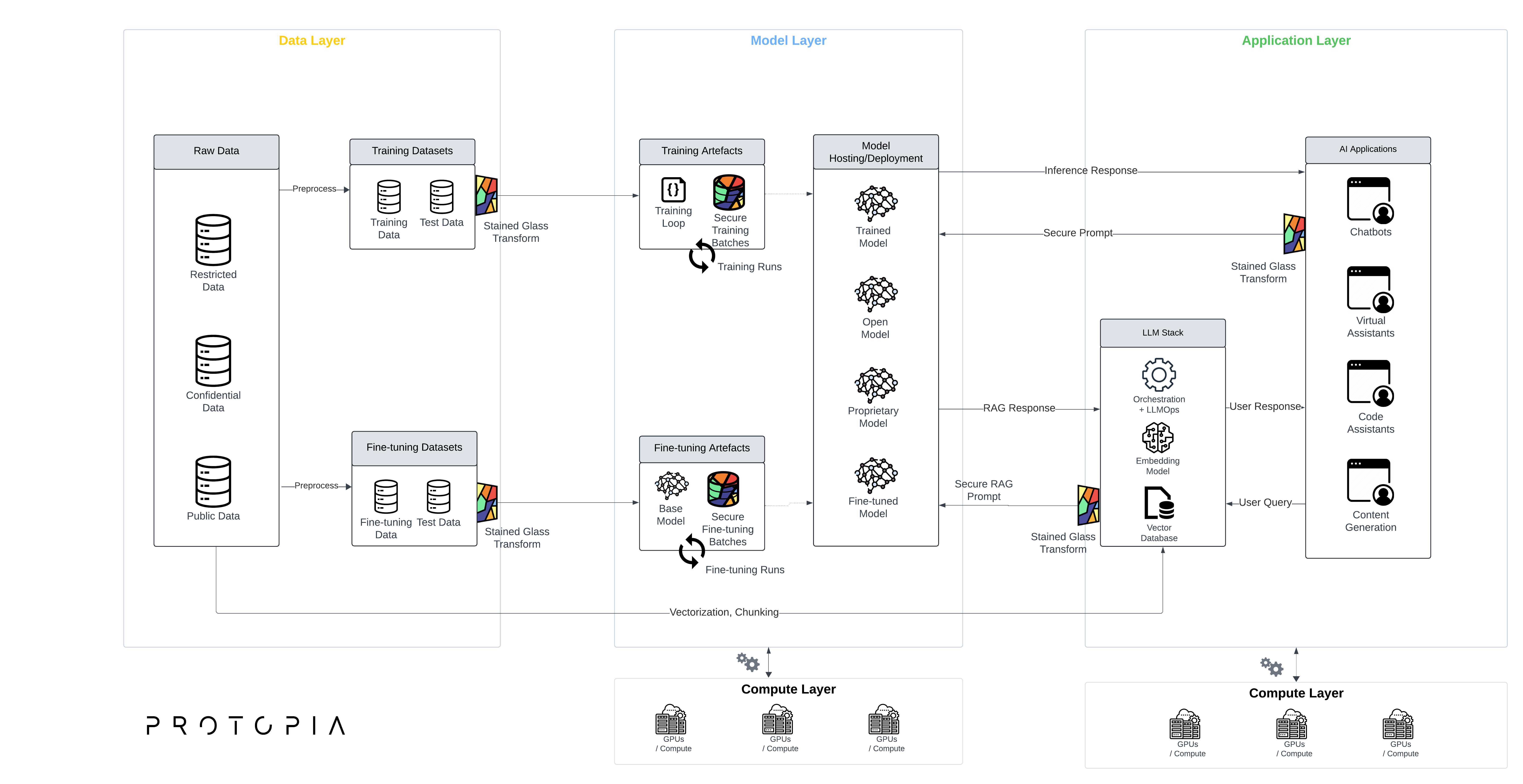

Modernize and unify your business processes with LLM solutions while retaining ownership of your sensitive data.

Whether you are fine-tuning your models to democratize access to data across departments or using proprietary LLM providers, ensure your crucial data has the best-in-class protection with Stained Glass.

Financial Services Use Cases

AML and Fraud Detection

Teams use Stained Glass Transform™ to collaborate on fraud and AML, KYC protocols, portfolio analytics, and regulatory reporting.

Unify Processes and Data-Driven Decisions

Financial and Insurance Organizations see unique opportunities in modernizing and unifying their data-driven decision processes using LLMs.

Stained Glass accelerates this journey by better protecting the sensitive data they need to use with state-of-the-art LLMs to achieve these business goals.

Building Applications on Foundation Models

Even when an LLM provider is chosen, data-related approval cycles for updates

can take time – resulting in delayed time-to-market for product teams building applications with foundation

models.

Stained Glass Transform alleviates concerns of exposing unprotected sensitive data to LLMs, allowing teams to bypass long approval cycles confidently.

Presentation from AI Summit in NY “How Q2 Accesses New Users for Fraud Detection with Breakthrough AI”

Q2’s Chief Data Scientist applies Protopia AI’s technology to enable check fraud detection for their financial institution customers – by giving them access to state‑of‑the‑art computer vision‑based fraud detection.

Latest News & Articles

The Executive’s Guide to Secure Data & Impactful AI | Part 2

Welcome back to our three-part series designed by and for leaders in data, information technology, and AI. In the first installment, we tackled the critical issue of overcoming barriers to data accessibility, exploring strategies to unlock the full potential of your data assets while ensuring compliance and security.

The Executive’s Guide to Secure Data & Impactful AI | Part 1

Overcoming Barriers to Data Accessibility for AI In partnership with Sol Rashidi, former CDAO at Fortune 100 organizations, and best-selling

Expand AI Innovation Securely with Protopia

As enterprises rush to adopt Large Language Models (LLMs) and Generative AI capabilities, executives face a dilemma. According to Gartner,